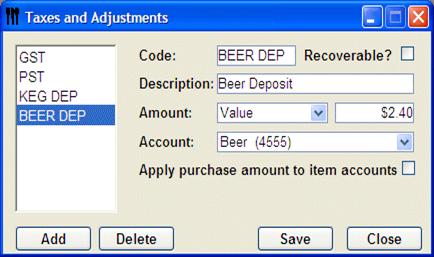

Adding and Deleting Taxes and Adjustments

![]()

To Add Taxes and Adjustments

-

From Upper Menu, click on File | Preferences.

-

Select Taxes and Adjustments.

-

Click on ADD.

-

Enter in Code for the tax. E.g. GST or PST and whether it is Recoverable.

-

Enter a Description.

-

Choose an Amount, either Value or Percentage.

-

Enter the Account that it is applied to.

E.G. GST is a tax, Deposit is a Beer Deposit -

Repeat these steps for all taxes and deposits or discounts you want to add.

-

Click Save and Close.

![]() You may get a message saying Please fill

in or delete 0.00 amount. This means that another tax that is set up

has no amount assigned. If you are not using that tax, remove it from the

list, otherwise enter an amount for the tax.

You may get a message saying Please fill

in or delete 0.00 amount. This means that another tax that is set up

has no amount assigned. If you are not using that tax, remove it from the

list, otherwise enter an amount for the tax.

To Delete a Tax or Adjustment

![]() Be sure that the Tax or Adjustment is not being used in any

Tax Groups.

Be sure that the Tax or Adjustment is not being used in any

Tax Groups.

-

From Upper Menu, click on File | Preferences.

-

Select Taxes and Adjustments.

-

Select the Tax or Adjustment you want to delete.

-

Click Delete.

-

Click Save and Close.