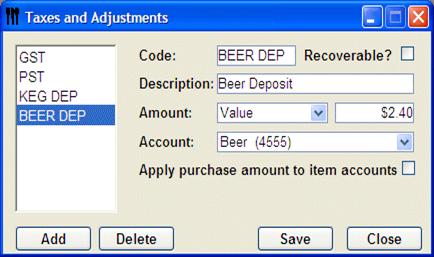

Taxes and Adjustments

Certain windows in the program use Tax information. To facilitate this we have a designed a feature that allows you to enter information about the taxes in your area. This feature can be used not only for Taxes, but also for Discounts, Deposits, Delivery Charges and just about whatever other charges would be applied to an Item cost.

Taxes And Adjustments Information

Code – Enter a code for this tax, a short code that will easily identify the tax for use in the Invoice window and Accounting reports. E.G. GST, PST or LIC DISC

Recoverable? – Some taxes, like GST are what we like to

refer to as recoverable, most discounts and or deposits are recoverable.

In other words, and this only applies if you are paying Tax In on your inventory

and you can request the Tax Back from your government.

E.G. In Canada, you

may pay $34.90 for a bottle of Vodka and this price may include GST. When

setting up the item Vodka, you would select a Tax Group that contains this tax

and when the costing is done by the Items Window, the GST will cost less the

included GST (or the real cost to you).

Description – Enter a name for the new tax or discount.

Amount – Is it a Percentage discount

or a fixed Value? Most taxes are

Percentages, or you may have a discount or licensee factor that

is a percentage as well. Other adjustments may be based on Value

(Fixed Amount).

E.G. You may want to create an Adjustment

called Bottle Deposit or 750ml Bottle Deposit

and choose Value as the type. In this case it

could be a fixed amount included on the item for example

$.50.

Account – Here you can indicate the Liability account that you wish any purchases to go against. By default you will see some accounts called Tax 1, Tax 2, and Tax 3. You can assign a tax to one of these accounts or go into the Chart of Accounts window and add a new account for your tax and assign. For discounts and/or deposits you may want to apply to the Beer account or Liquor account.

Apply purchase amounts to item accounts – Check this box if a sales tax applies to an item. Such as sales tax to a cleaning supply or paper goods. You may pay 8.00 for a case of bleach but there is a non recoverable sales tax applied of $.56. The actual cost of the bleach is $8.56. To apply the tax to the correct account in the chart of accounts, check this box and for each line in the invoice this tax will be added to the chart of account for the item selected.

Adding and Deleting Taxes and

Adjustments

Adding and Deleting Taxes and

Adjustments