Taxes and Tax Groups

![]()

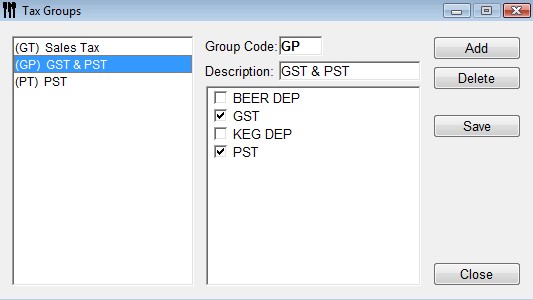

A Tax Group is the set of taxes, discounts or deposits that are applied to the cost and or purchase price of that item. You can have Federal Tax applied to one item and Local Tax and Federal Tax to another. Many dry goods and beer/liquor items vary in what taxes are applied.

![]() You must set up the Taxes and

Adjustments before assigning Taxes and Tax Groups.

Taxes and Adjustments are the different Taxes, Deposit fees, Discounts that you

need to set for your area.

You must set up the Taxes and

Adjustments before assigning Taxes and Tax Groups.

Taxes and Adjustments are the different Taxes, Deposit fees, Discounts that you

need to set for your area.

To Create a Tax Group

-

From the Upper Menu, click File | Preferences | Tax Groups.

-

Click Add.

-

Enter in Group Code for the tax group. A two digit code is required. E.G. PT, GP, GT

-

Enter the Description for the Group.

-

Check off the taxes to include. Refer to Taxes and Adjustments to add new taxes.

-

Click Save and Close.

-

From the Items window, check Price Incl. Tax Grp. and select the tax group from the Tax Grp. drop down box.

Tax Groups

Tax Groups